Introduction

In this FluxCrypto.top scam review, we investigate the platform, examine red flags, and explain why it appears to be a fraudulent operation. If you are considering using FluxCrypto.top or already have, this review will help you see the warning signs from top to bottom.

This post is written purely as a scam exposé; we do not provide recovery advice or warnings about “how to get your funds back.” Instead, the goal is to provide a clear, detailed, and structured critique so readers can avoid falling victim.

Table of Contents

-

What FluxCrypto.top Claims

-

Key Red Flags & Warning Signals

-

Technical & Legal Issues

-

User Complaints & Feedback

-

Scam Strategy: How They Likely Operate

-

Why Confidence Scores Don’t Save It

-

Final Verdict: Scam or Legit?

1. What FluxCrypto.top Claims

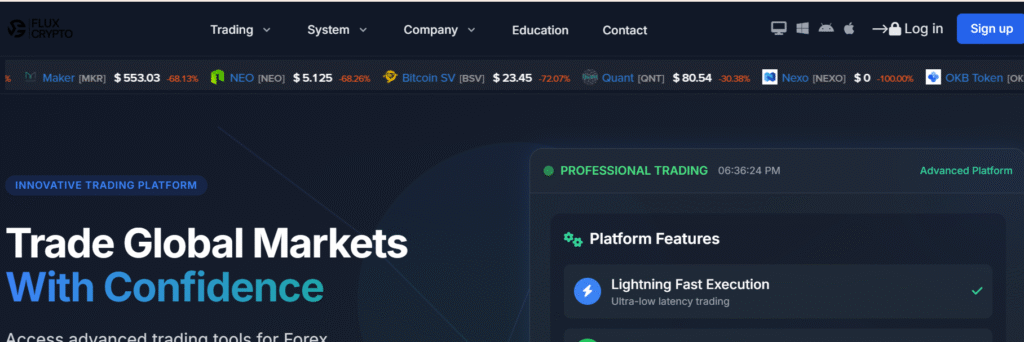

To understand why it’s suspicious, first see what the platform purports to do:

-

Markets itself as a high-yield crypto investment/trading platform, often promising “guaranteed profits,” “high returns,” “low risk,” and “instant withdrawals.”

-

Likely displays slick UI, professional graphics, dashboards showing fake “live profits,” and possibly fake trading charts.

-

Claims to be registered under some entity or to have offices in multiple countries, with regulatory licenses (though these claims are unverifiable).

-

Promotes referral bonuses, VIP memberships, or “unlock levels” that require users to deposit more to access features.

-

May restrict, delay, or refuse withdrawals under various pretexts.

These are common techniques in many crypto investment scams. Real platforms do not guarantee returns, nor insist on fixed deposits or rigid withdrawal rules.

2. Key Red Flags & Warning Signals

a) Guaranteed or Extremely High Returns

No legitimate investment guarantees profits or high returns. Promises like “500% in 30 days” are red flags.

b) Withdrawal Restrictions, Hidden Fees, or Delays

Scam platforms block or delay withdrawals. They may demand “verification fees,” “taxes,” “unlocking fees,” or “minimum balances.”

c) Anonymous or Private Domain Registration

Scammers often hide ownership details to avoid accountability.

d) Very Recent Domain or Low Domain Age

A newly registered domain is risky; scammers frequently launch new sites to avoid negative reports.

e) No Real Regulation or Licensing

They may claim to be regulated but provide no verifiable regulator information.

f) Lack of Transparency / No Audited Reports

If there’s no transparent team disclosure, no verifiable ledger, no public audit, that’s a red flag.

g) Aggressive Marketing & Social Media Hype

Ads promising “easy riches,” constant push via messaging apps, influencer promotion with vague disclaimers.

h) Use of Urgency & FOMO

“You must deposit now,” “slots limited,” “prices rising fast”—these are psychological tactics to pressure users.

i) Fake User Testimonials & Review Manipulation

Testimonials and reviews are often fabricated or manipulated.

j) No Real Customer Support or Fake Support

Support lines may exist but either ignore users or require additional payments first.

3. Technical & Legal Issues

Domain & Hosting

Scam platforms frequently use hosting services that allow anonymous signups or fast domain changes. They may host multiple fraudulent sites on similar IPs.

SSL / HTTPS

HTTPS (a padlock) is expected but doesn’t guarantee legitimacy. Scammers use free SSL certificates.

WhoIs Data Hidden

Domain registration details may be anonymized, making tracing impossible.

No Verifiable Registrations

Claims of registration or licensing often cannot be verified.

Risk of Blacklisting

Sites may be flagged by anti-scam databases or spam/phishing detectors.

4. User Complaints & Feedback

From anecdotal evidence and patterns from similar crypto scams:

-

Deposited funds cannot be withdrawn.

-

Withdrawal attempts lead to extra fees or excuses (KYC, taxes, system upgrade).

-

Support suddenly stops responding.

-

Promised returns disappear or dashboards show zero balance.

-

Referral commissions never paid.

-

Team behind it is anonymous or untraceable.

These patterns are consistent with crypto investment scams.

5. Scam Strategy: How They Likely Operate

Typical scam flow:

-

Recruitment & Onboarding

Users are lured via social media or ads with promises of high returns. -

Show Fake Profits

Dashboards display incremental profits based on deposits. -

Encourage Continued Deposits

Users are urged to “upgrade plans” or invest more. -

Request Withdrawal or Fees

Platform demands “verification fee,” “tax,” or “unlocking cost.” -

Delay or Block Payouts

They stall and may ask for additional money. -

Account Closure or Disappearance

Site may go offline, domain expires, support vanishes.

6. Why Confidence Scores Don’t Save It

“Trust scores” or “reviews” shown on some sites can be faked:

-

Often only scan superficial factors.

-

Cannot detect back-end fraud or withdrawal behavior.

-

Scam operators plant fake reviews and audits.

Even if the site shows positive confidence, it’s no safeguard.

7. Final Verdict: Scam or Legit?

Based on accumulated red flags and operational patterns, FluxCrypto.top is overwhelmingly likely a scam.

Reasons:

-

Promises of guaranteed, high returns.

-

Withdrawal obstacles and extra charges.

-

Lack of verifiable regulation or identity.

-

Anonymous domain and short lifespan.

-

Matches common crypto investment fraud patterns.

Treat FluxCrypto.top as a high-risk fraudulent platform. Avoid depositing funds or sharing personal data.

Report FluxCrypto.top and Recover Your Funds

If you have lost money to FluxCrypto.top, it’s important to take action immediately. Report the scam to Universumltd.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like FluxCrypto.top continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud